As from 2024, the National System of e-Invoices, a platform intended for issuing and receiving invoices by electronic means, will become mandatory for all taxpayers. Therefore, the companies need to find the right system to integrate their ERP systems with the government platform. This is a challenge – especially if data from multiple sources has to be integrated. We have a ready solution for such a problem – the proprietary TalTax system.

What is the National System of e-Invoices?

Above all, digitization is supposed to make our life easier – remove everyday inconveniencies and replace them with user-friendly modern solutions. The national System of e-Invoices, in Polish: KSeF for short, is no different. Farewell to paper brings many benefits, which all entrepreneurs shall already be aware of in 2024, since from the beginning of next year KSeF will become an obligatory solution.

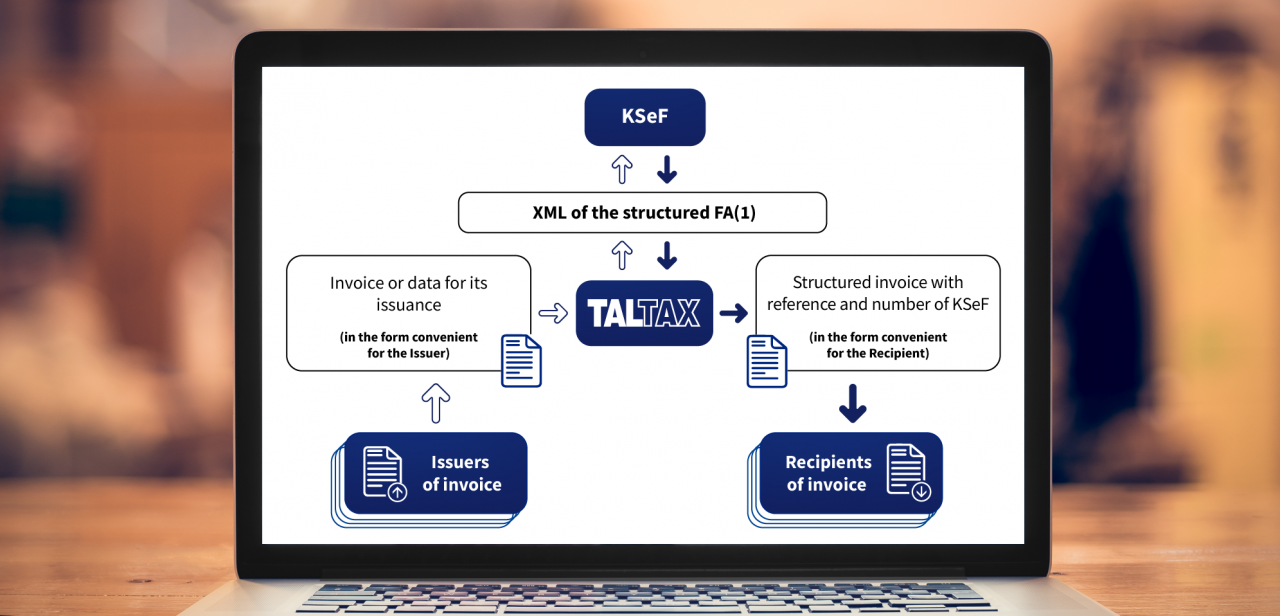

KSeF is an ICT system administered by the National Revenue Administration of Poland that is used for the issuance, reception, and storage of electronic invoices. And what exactly is a structured invoice? It is a document created in XML format which is compliant with the logical structure of the FA(1) e-invoice generated in accordance with the template set by the Ministry of Finance.

And this is where TalTax KSeF, a proprietary system developed by TALEX SA specialists, can be of help to a number of companies.

You can learn more about KSeF here: www.podatki.gov.pl/ksef/ (Polish only)

Integration with TalTax KSeF

To fully appreciate the benefits of the KSeF platform, it is worth to invest in a comprehensive IT solution that integrates the customer’s existing ERP systems processing invoices with the National System of e-Invoices.

TalTax has been on the market for several years. It is our proprietary platform that is used for the preparation of JPK files and sending them to the Ministry of Finance. The Taltax KSeF solution is part of this platform.

TalTax is continuously developed and is subject to modifications in line with changing regulations and customer needs. Our platform is easy to use, has many useful functionalities and a very user-friendly graphical interface.

The TalTax system has unique features that make it stand out in the market. First and foremost, it is addressed to organizations that need to integrate data from various sources in advance and carry out data validation and normalization. The integration of multiple ERP systems has never been so simple.

What can TalTax do? Learn about its numerous advantages.

- The solution is scalable and can integrate with multiple accounting systems and multiple entities present, such as financial groups or franchise dealerships.

- It has a local invoice repository and the ability to download invoices in pdf format.

- It provides conversion of flat files, e.g. txt, csv or iDoc files issued by SAP. The files are converted to the XML format of the FA(1) structured invoice.

- It transmits invoices to the source systems in the format required by them.

- It automatically notifies customers of invoices issued to them.

- It has a mechanism for the distribution of invoices in PDF format to selected recipients.

- It has a dedicated repository for uploading attachments, for example an acceptance protocol.

- It can work in the client’s environment or on dedicated Talex Data Centre resources.

Is it a good idea to start using the KSeF today?

As previously mentioned, KSeF will become a mandatory platform as early as 2024. Unfortunately, the integration process may take more time with a complex company structure. So to answer the question in the headline: it is not only worth it, it is necessary to start the integration process with KSeF as soon as possible. The new system should be tested early enough to avoid the high penalties that the Ministry of Finance has planned. The consequence for a failure to issue invoices according to the new standards can be a penalty of 100% of the amount of tax shown on a given invoice (not less than 1000 PLN). If tax is not shown, the sanctions will be up to 18.7 % of the amount shown on the invoice.

The consequences of not integrating with the National System of e-invoices are serious, but let us also remember the benefits of using the KSeF platform. It is precisely because of them that it is worth accelerating the integration process. And the best way to do so is together with TalTax KSeF. What can you gain already today?

The benefits of KSeF:

- 20 days faster deadline for VAT refunds;

- No more paperwork and necessary archiving;

- Faster workflow of invoices;

- Permanent and easy access to all invoices;

- Shorter controls, faster document and information workflow;

- A standardized format means fewer errors and a higher level of security.

As you can see, it is not worth waiting until 2024. Especially when there is such a comprehensive solution on the market as Taltax. Are you looking for such a system for your company? Perhaps your problem is finding a system that integrates data from several ERP systems in your corporate group?

Do not hesitate, start integrating with KSeF today.

Please, feel free to contact us, we will be happy to answer your questions and provide you with an offer.

You can email us at: kontakt@talex.pl